The tension between the United States and China has once again taken center stage—not over weapons or diplomacy, but tariffs. In April 2025, the US announced a new round of economic sanctions against China, raising tariffs on imported products to as much as 104%. In response, Beijing hit back with force: 84% in surcharges on American goods and a blacklist of “unreliable entities.” This latest chapter of the recession and trade war between the two powers reignited global alarms, amplifying the impact of economic decisions on global supply chains.

As expected, the consequences were immediate. Markets fluctuated, oil prices dropped, and banks like JPMorgan and Goldman Sachs revised their global growth forecasts. For many experts, the message is clear: we’re flirting with a new recession.

But a legitimate question arises: is the threat real? Or is this just another episode of temporary instability in a world used to chaos?

More than anything, this new trade dispute exposes a deeply imbalanced system—and perhaps, a crisis that no longer depends solely on political decisions to take root.

What’s at Stake in the Tariff War

This latest round of conflict between the US and China isn’t just about tariffs. It’s a symbolic escalation that reveals how trade has become a geopolitical weapon. In the context of a recession and trade war, this battle goes beyond economics—it’s about shaping the future of global power structures.

In April 2025, the US raised tariffs to 104% on a wide range of Chinese goods. The move was justified as a response to Beijing’s “unfair” trade practices and as a protective measure for strategic American industries.

China’s retaliation was swift and severe: 84% tariffs on American goods and a blacklist targeting 12 US companies, including major players in semiconductors and technology.

Beijing also filed a formal complaint with the World Trade Organization (WTO), accusing the US of violating international trade rules.

These actions go far beyond spreadsheets and economic forecasts. They directly affect production chains, global investment strategies, and financial stability—even for countries not directly involved in the conflict.

This is more than a dispute over trade advantages—it’s a battle over who sets the rules of global commerce, and with that, who holds geopolitical influence in the 21st century.

You may also be interested in: Hollywood could lose China? The Impact of Trump’s Tariffs on Global Cinema

Economic Signals Raising the Alarm

The rising tensions between the US and China have reignited fears that had been looming for months: the risk of a global recession. Within the current recession and trade war landscape, every economic tremor is being monitored more closely.

The first major warning came from large financial institutions. JPMorgan increased its estimate of a US recession to 60%, citing the direct impact of tariffs on trade slowdown and investment pullbacks. Goldman Sachs, on the other hand, revised its outlook to say a recession is no longer the most likely outcome—but risks remain.

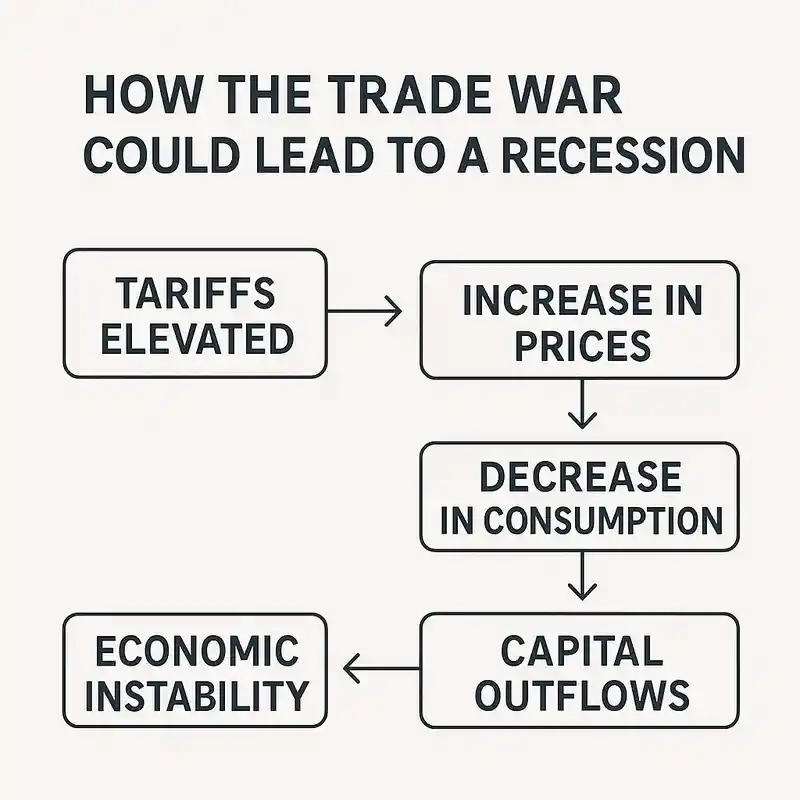

In general, tariffs act like brakes on the natural flow of the economy. When a country raises barriers on imports, domestic prices rise, global production reorganizes, and consumption slows. This weakens growth.

Some early consequences are already visible:

Brent crude oil prices dropped over 6%, reflecting expectations of reduced global economic activity.

Sectors dependent on imported materials, such as technology and manufacturing, report rising costs and risk of shortages.

Investor confidence has taken a hit, leading to volatile markets and capital flight from emerging economies.

Moreover, global trade—already weakened since the pandemic—now faces another hurdle in its recovery. This mix of rising costs, falling consumption, currency instability, and uncertainty creates fertile ground for a silent crisis.

The Recession Ghost: Real Threat or Overreaction?

With so many red flags, the inevitable question arises: are we truly on the edge of a recession, or are we overestimating the signs?

The fear of a new economic crisis doesn’t stem solely from this trade war. It’s rooted in a fragile global backdrop shaped by a recent pandemic, regional conflicts, climate change, and political instability—each of which has chipped away at faith in sustainable growth.

However, not every slowdown leads to a full-blown recession. Governments and central banks still have tools at their disposal: interest rate cuts, fiscal stimulus, bilateral trade agreements, and emergency renegotiations. Many are already in motion.

In the United States, for instance, the very government that imposed the new tariffs chose to temporarily suspend part of them for a 90-day period — but not for China. Similar measures are being discussed in Europe and Asia, as part of an effort to prevent the tariff escalation from turning into a systemic crisis.

Still, the fear persists—and it’s not irrational. The world is more interconnected than ever, and economic shocks spread fast. One broken link can destabilize the entire system.

Perhaps the greatest danger isn’t economic, but psychological. The expectation of recession—fueled by headlines and memories of past crises—can become a self-fulfilling prophecy. If businesses and consumers pull back out of fear, that very pullback becomes real.

You may also be interested in: Economic Fear: The Silent Contagion

Consequences for Everyday People

At first glance, a tariff war between giants may seem distant—something debated by technocrats in closed-door meetings. But the consequences reach the everyday consumer quickly.

Tariffs work like invisible taxes. When import costs rise, that burden travels down the line: manufacturers pay more for materials, retailers hike up prices, and final products become more expensive. From food to electronics, prices climb.

The uncertainty also hits the job market. Without clear forecasts, companies freeze hiring, cut investments, and reduce inventories. That leads to:

Higher unemployment, especially in export-dependent or import-reliant industries.

Tighter credit, with rising interest rates and restricted access.

Currency devaluation, making travel, study abroad, and tech gadgets more expensive.

In Brazil, the effects are already being felt in commodities. As a global supplier of food and raw materials, Brazil is sensitive to slowdowns in global production. A cooling Chinese economy means less demand for soybeans, beef, and iron ore—pillars of the country’s trade balance.

There’s also the psychological toll: consumers cut spending, families delay major decisions, and fear returns to dominate both the news and daily life.

What once felt far away becomes tangible: wallets tighten, markets grow anxious, and a sense of instability settles in.

A System Out of Balance: A Deeper Analysis

Behind the tariffs, sanctions, and disputes lies a deeper issue: a global economic system already out of sync—and now showing its limits more clearly than ever.

For decades, international economics relied on the idea of integration: global supply chains, free trade, and interdependence as guarantees of stability. But wave after wave of crisis—financial, health-related, geopolitical—has revealed how fragile that network really is. Interdependence has brought vulnerability, not security.

The recession and trade war between the US and China are just the most visible signs of this structural imbalance. What we’re witnessing is the collapse of an illusion: major powers pretending to cooperate while simultaneously preparing for containment, nationalism, and tech domination.

This instability also reveals an under-discussed dimension: the role of collective emotions in shaping economic behavior. Fear of collapse, resentment toward rival powers, nostalgia for idealized sovereignty—all of these fuel protectionist policies that, at their core, are attempts to regain control amid chaos.

There’s also a conflict of rhythms at play:

Political decisions operate on short-term cycles, driven by elections and popularity.

But the economic and social consequences unfold slowly, unpredictably—and often irreversibly.

We may be entering a new era: less globalized, more suspicious, with economic blocs closing ranks and rearming financially. In this climate, any abrupt move—like the one we’re seeing—could trigger a domino effect that’s hard to stop.

Conclusion: Are We Fueling the Recession Amid the Trade War?

In uncertain times, it’s tempting to point fingers—reckless leaders, poor policy, power games. But maybe the harder question is: how much of this looming recession is a result of repeated, conscious collective choices?

The US-China trade war didn’t happen in a vacuum. It reflects a world that traded cooperation for rivalry, stability for imposition, and dialogue for brinkmanship.

Tariffs are just symptoms. What we’re witnessing is a struggle for dominance in an already fragile post-pandemic economy.

If a recession does happen—and it’s not inevitable—it won’t be due to a single misstep. It will be the outcome of a system pushed to its limits, battered by shocks, and driven by short-sighted interests.

The question remains: are we ready to face a crisis we ourselves are helping create?

We also recommend:

- Hollywood could lose China? The Impact of Trump’s Tariffs on Global Cinema

- Avatar: Fire and Ash – Premieres on December 19, 2025

- Obama Joins Bluesky — and What That Reveals About the Future of Social Media

Posts Recomendados

Carregando recomendações...